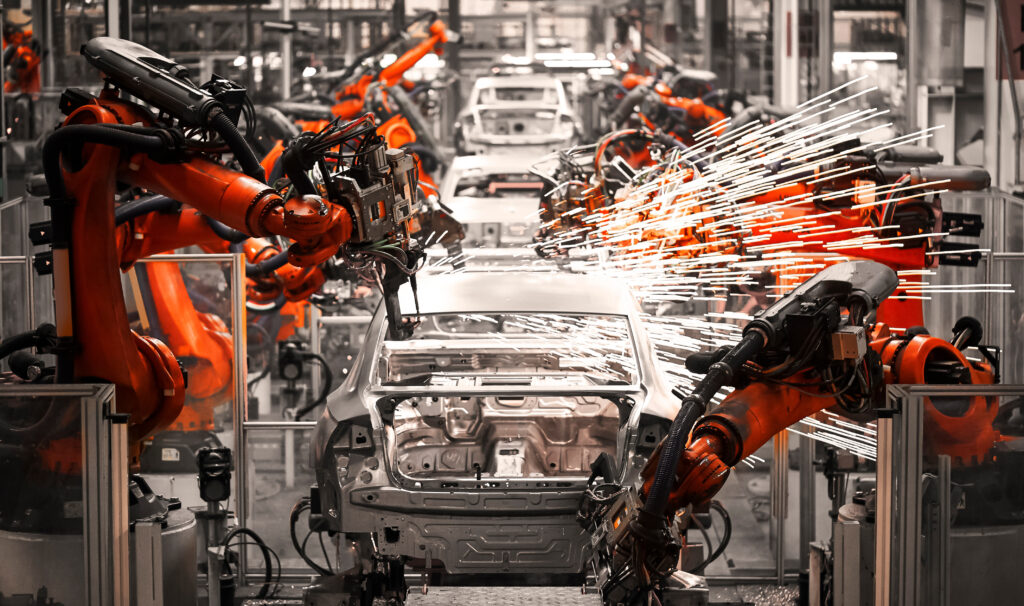

- ManuSec Canada 2025 in Toronto wasn’t just another industry gathering; it was a crucial deep dive into the rapidly evolving challenges and fundamental shifts shaping the future of data security, especially within the critical manufacturing sector. Ron Arden from Fasoo Inc. delivered a compelling session that served as a stark wake-up call, underscoring the urgent need for a new paradigm in the face of relentless technological advancement. Are you truly confident that your...

- ManuSec Canada 2025 in Toronto wasn’t just another industry gathering; it was a crucial deep dive into the rapidly evolving challenges and fundamental shifts...