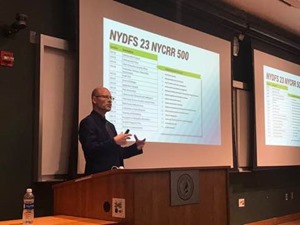

- Ron Arden, Executive Vice President and COO of Fasoo, Inc., presented Countdown to Compliance with NYDFS 23 NYCRR 500 during FinCyberSec 2017 at the Stevens Institute of Technology in Hoboken, NJ on May 31, 2017. Ron was part of a day long event that focused on technical, regulatory, process and human dimensions of cyber threats faced by financial systems and markets. Dr. Paul Rohmeyer, who organized the conference, started the day with opening remarks...

- Ron Arden, Executive Vice President and COO of Fasoo, Inc., presented Countdown to Compliance with NYDFS 23 NYCRR 500 during FinCyberSec 2017 at the...